Market Spotlight:

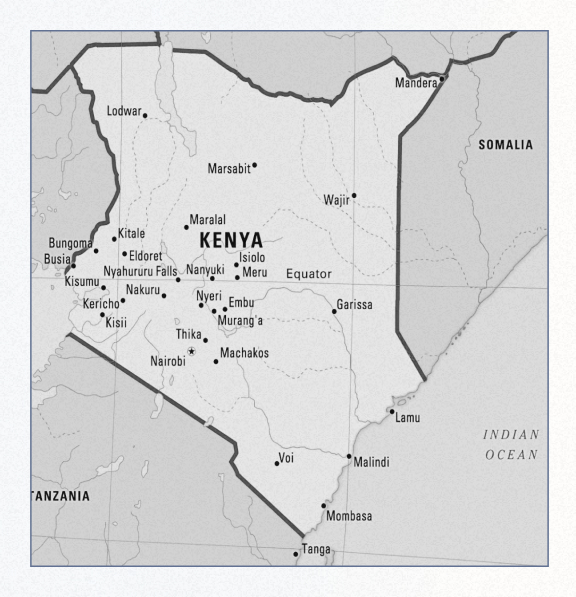

Kenya

Factum Scale:

-

Kenya ranks 56th of 190 countries on the World Bank’s Ease of Doing Business Index, reflecting its moderately business-friendly environment. While the country has made strides in streamlining business registration processes and reducing bureaucratic red tape, challenges remain in dealing with construction permits, property registration, and contract enforcement.

-

To start a business in Kenya, the registration process typically takes about 7 to 10 days, although it can sometimes extend up to 21 days depending on the specifics of the business and the efficiency of document submission and approval processes.

-

Kenya ranks 4th globally in the “Getting Credit” category on the World Bank’s Ease of Doing Business Index which is a significant strength; a result of comprehensive credit information systems and strong legal rights for borrowers and lenders.

-

Kenya’s weakest measures are dealing with construction permits ranking 105th out of 190 economies in the “Dealing with Construction Permits” category. The process involves numerous procedures and takes an average of 159 days to obtain all necessary permits and complete the construction-related formalities.

-

Kenya ranks 134th out of 190 economies in the “Registering Property” category. This process involves several steps with significant time and cost. On average, it takes 49 days to complete property registration.

Tariffs & Regulations

Factum Scale:

-

Kenya’s tariff structure is straightforward, with most goods subject to standard import duties. The country is a member of the East African Community (EAC), which simplifies trade procedures and reduces cost of doing business across the region; this regional cooperation enhances Kenya’s attractiveness for business looking to expand within East Africa. However, navigating local regulations and compliance requirements can be complex, requiring local partners who can assist with thorough due diligence.

-

Kenya’s average applied MFN tariff rate for all trading partners stood at 14.3% in 2022, according to the latest available WTO data. S. exports, particularly machinery and aircraft, encounter minimal or zero tariffs. However, Kenya’s agricultural sector imposes the highest tariff barriers for U.S. exports, averaging 24.5%.

-

Kenya also benefits from preferential access under the African Growth and Opportunity Act (AGOA) with the U.S., where over 75% of Kenyan exports enter the U.S. duty-free.

Fluency in English

Factum Scale:

-

English is one of Kenya’s official languages and is widely spoken across the country, especially in business and government sectors. This high proficiency in English facilitates easier communication for international businesses engaging with local startups and partners.

-

Due to the country’s colonial history and its integration into the global economy, English proficiency is crucial for corporate and trade-related interactions.

-

Kenya’s education system heavily focuses on English as a means of preparing students for participation in both local and global markets.

Labor

Factum Scale:

-

Kenya offers a competitive labor market with a youthful and increasingly skilled workforce. The country has a labor force participation rate of 75%, significantly higher than the global average of 59%.

-

Significant investments in education and technical training have improved the quality of the labor force, particularly in tech-related fields. Kenya also has one of the youngest workforces in Africa, with about 75% of the population under the age of 35. (40% of people under 35 are currently employed.)

-

However, according to the National Bureau of Statistics’ Economic Survey 2023, as of May 2023, over 83% of Kenya’s working population works in an informal sector, which often lacks job security, benefits, and adequate working conditions.

Economic Stability

Factum Scale:

-

Kenya is one of Africa’s leading, most stable economies with a diverse economic base. Over the past decade, Kenya has implemented substantial political and economic reforms, resulting in sustained economic growth, social development, and political stability. The country’s growth is expected to average 5.2% from 2024 to 2026, driven primarily by a strengthening private sector and a scaling-back public sector.

-

Kenya’s economy has demonstrated resilience with a growth rate of 5.2% in 2023, up from 4.8% in 2022. Primarily driven by a rebound in agriculture and moderate growth in the services sector, which accounts for a significant portion of the GDP growth

-

Kenya’s public debt increased from 66.7% of GDP in 2022 to 70.2% in 2023, driven by higher borrowing to finance the fiscal deficit and exchange rate depreciation, posing a risk to fiscal sustainability and economic stability.

-

Additionally, inflation remained elevated at 7.7% in 2023, slightly up from 7.6% in 2022, driven by core and fuel inflation, prompting the central bank to hike the policy rate significantly to 12.5% to anchor inflation expectations, highlighting challenges in maintaining price stability.

Society, Culture, and Business Etiquette

Factum Scale:

-

Kenya’s society is diverse and dynamic, with a mix of various ethnic groups and cultural influences with a majority of the population being Christian.

-

In business, Kenyans value relationships, trust, and respect. Punctuality is important, and it is customary to engage in some informal conversation before getting down to business. Business attire is typically formal, especially in corporate settings.

-

Greetings are very important in Kenyan culture. A firm handshake is common, and people often inquire about each other’s health and family. Address people by their titles and last names until invited to use their first names

Tech Innovation

Kenya is recognized as a hub for tech innovation in Africa, particularly known for its advancements in mobile payments and agritech. The country is home to M-Pesa, one of the world’s most successful mobile money platforms, which has revolutionized financial inclusion and services. Additionally, the agritech sector is flourishing, with startups leveraging technology to improve agricultural productivity and sustainability.

Key Areas for International Engagement

-

Mobile Payments: Kenya’s mobile payment ecosystem offers numerous opportunities for international businesses to partner with local fintech companies. This includes developing new financial products, expanding mobile banking services, and enhancing digital payment solutions.

-

Agritech: With a significant portion of the population engaged in agriculture, there is a high demand for innovative agritech solutions. International businesses can collaborate with local startups to introduce advanced farming technologies, data analytics, and supply chain improvements.

-

Startup Ecosystem: Nairobi, often referred to as “Silicon Savannah,” hosts a vibrant startup scene supported by numerous incubators, accelerators, and venture capital firms. Engaging with this ecosystem can provide access to innovative solutions and potential partnerships.

-

Infrastructure Development: Recent improvements in physical and digital infrastructure have created a conducive environment for tech businesses. Continued investment in infrastructure will support the growth of tech hubs and enhance connectivity.

Business Structures

-

Limited Liability Company (LLC): LLCs are popular for foreign investors and can be wholly foreign-owned. They require at least one director and one shareholder, with no minimum capital requirement.

-

Branch Office: A branch office acts as an extension of a foreign company in Kenya. It can engage in commercial activities but is not considered a separate legal entity.

-

Representative Office: This setup allows foreign companies to establish a presence in Kenya to promote their products and services without engaging in direct commercial activities.

Business Landscape

-

Kenya’s economy is characterized by a mix of state-owned enterprises (SOEs), small and medium enterprises (SMEs), and a thriving informal sector. The government is actively promoting innovation and entrepreneurship through various initiatives and incentives.

-

Kenya’s tech sector, often referred to as “Silicon Savannah,” has been rapidly expanding. Nairobi is home to a burgeoning tech startup ecosystem, with innovations in mobile technology and fintech attracting international investors. The government also supports this sector through initiatives like Konza Technopolis, a planned smart city aimed at boosting tech-driven industries.

-

Kenya’s business landscape is vibrant, particularly in technology, finance, and services. However, businesses must navigate regulatory challenges, infrastructure limitations, and a competitive regional environment. With its growing middle class, strategic position, and government initiatives to foster business development, Kenya offers significant opportunities for both local and international firms.

Notable Institutions

-

Kenya Investment Authority (KenInvest): Facilitates investment by providing information and assistance to investors.

-

Communications Authority of Kenya (CA): Regulates the ICT sector and promotes competition and innovation.

-

Kenya Private Sector Alliance (KEPSA): Represents the interests of the private sector and fosters a conducive business environment.