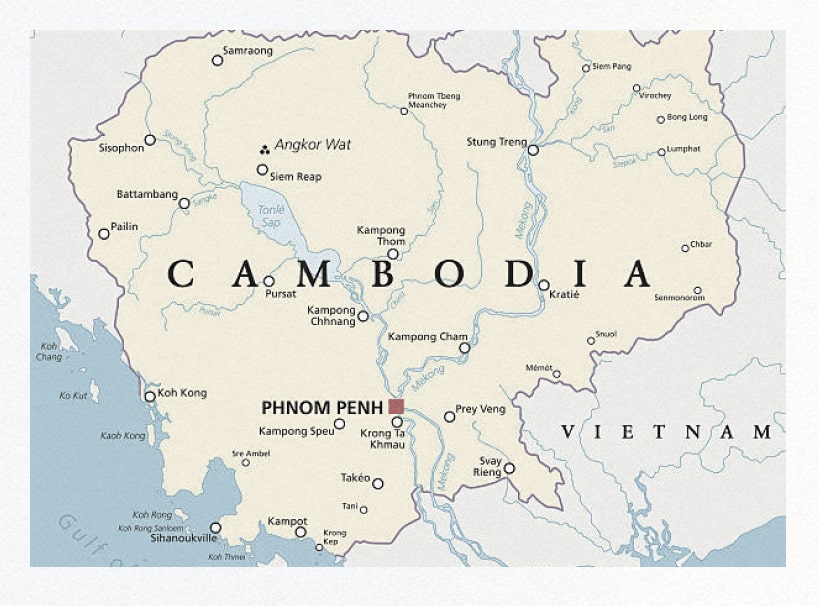

Market Spotlight:

Cambodia

Factum Scale:

-

Cambodia is ranked 144 of 190 countries on The World Bank’s Ease of Doing Business Index, relatively low due to high levels of corruption (ranks 150 of 180 countries on the Corruption Perceptions Index) and a complex, bureaucratic environment for setting up new businesses (ranking 171 or 183 countries), with an average of 85 days to register a new business.

-

The Ministry of Commerce aims to reduce registration for 100%-owned foreign companies to 8-10 days, as detailed in the 2021 passage of The Law on Investment in the Kingdom of Cambodia.

-

Cambodia also has weak national infrastructure due to decades of conflict and civil war, though recent policies have greatly improved the physical infrastructure (roads, railways, waterways, and airways) and non-physcial infrastructure (expansion of internet connectivity and lowerwing electricity prices).

-

Recently passed laws aim to establish an open, transparent, and improved legal framework that is favorable for foreign investment. It also softens once stricter laws on private property protection and fair market competition, includes investment incentives (e.g., tax exemptions), a streamlined investment approval process, and a one-stop shop for investment registration.

Tariffs & Regulations

Factum Scale:

-

Cambodia has a relatively simple tariff structure, with most goods subject to a single import duty rate. It has three types of import duties and taxes: customs import duties, a special tax for certain goods, and a value-added tax (VAT). The average applied tariff rate in 2022 was 11.7%.

-

Customs import duties: a tax on the value of imports. The rate of the duty varies depending on the type of goods you are importing.

-

Special tax: a tax on certain types of goods, such as alcoholic beverages and tobacco.

-

VAT: a 11.7% tax on the value of imports, plus the value of any customs import duties and special taxes you have paid.

-

Tax Exemptions: agricultural equipment and inputs, school materials and equipment, pharmaceutical products, and sporting goods.

-

Cambodia’s most important trade agreement is the Cambodia-China Free Trade Agreement (CCFTA), which came into effect in January 2022. The CCFTA has eliminated tariffs on over 90% of goods traded between Cambodia and China. This is expected to boost trade between the two countries and help to grow the Cambodian economy.

-

Cambodia is a member of the Association of Southeast Asian Nations (ASEAN), which has a free trade area with a number of other countries in the region. The ASEAN Free Trade Area (AFTA) eliminated tariffs on most goods traded between ASEAN member countries, helping to boost intra-ASEAN trade and has made Cambodia a more attractive destination for foreign investment.

-

In addition to the CCFTA and AFTA, Cambodia has also signed trade agreements with a number of other countries, including the United States (TIFA), Japan (EPA), South Korea (CKFTA), and the European Union (GSP). These agreements have helped to diversify Cambodia’s trade and to reduce its reliance on a few key markets.

Fluency in English

Factum Scale:

-

English is the dominant language for diplomacy and international business, however, more broadly Cambodia has as a ‘very low’ national English proficiency, ranking 20 out of 24 nations in the region, according to the Education First English Procificeny Index.

-

Khmer, Cambodia’s official language, is spoken by 3% of the total population. French, once the official language of Cambodia as a colony from 1863-1953, has since declined but still spoken by older Cambodians.

-

Today, English has become the main foreign language, with bilingual signs scattered across the country. Other spoken languages include Vietnamese, Lao, Mandarin, and Thai.

-

Young Cambodians and urban residents are more likely to speak English fluently. Some government initiatives, such as English as a compulsory subject in schools, English training programs and partnerships with English native-speaking embassies (e.g., S. Embassy English Language Fellows Program) are improving rates of English fluency.

Society, Culture, and Business Etiquette

Factum Scale:

-

Cambodian society is deeply rooted in Theravada Buddhism, which emphasizes respect for elders, hierarchy, and community.

-

Cambodians are generally reserved, indirect communicators, and value politeness and harmony. Its culture is rich, diverse, and nationalistic with influences from India, China, and other Southeast Asian countries.

-

Punctuality and patience are important in Cambodian business culture. It is best to arrive a few minutes early for meetings and be prepared for slow, time-consuming negotiations. Be prepared to walk away, if necessary.

-

Greetings are formal and respectful. When meeting someone for the first time, it is customary to shake hands and bow slightly.

-

Business cards are exchanged in Cambodia, and it is best to have them translated into Khmer on one side.

-

Hierarchy is important in Cambodian business culture, and it is best to show deference to elders and superiors. Be mindful of the order in which you enter a room and be sure to allow the most senior member of your delegation to enter first.

Economic Stability

Factum Scale:

-

Cambodia is the 110th freest economy of 176 countries indexed, and 24th out of 39 countries in the Asia-Pacific.

-

It had an average gross domestic product (GDP) growth rate of 7.1% from 1994 to 2021, one of the fastest growing economies in the Association of Southeast Asian Nations (ASEAN). The International Monetary Fund predicts Cambodia to be the fastest growing economy in Southeast Asia by 2025.

-

Cambodia borders Thailand, Laos, and Vietnam, and is a member of ASEAN, giving businesses access to a market of over 660 million people and a consumer market value of over $1 trillion. It is also located on the Gulf of Thailand and has access to the South China Sea, two of the busiest global shipping routes, making it easier and more cost-effective to import and export goods than in other parts of the region.

-

In terms of the likelihood and ability to deal with crisis, Cambodia ranks 54th of 179 indexed countries (1 = the most likely for a crisis to occur) (according to the Fragile States Index).

Labor

Factum Scale:

-

Cambodia offers some of the most affordable labor in the region. Average monthly wages are between USD$187 and $192, allowing businesses to allocate resources elsewhere.

-

The country also has a labor force participation rate of 76%, largely above the global average of 59%, comprising a significant portion of the population (The World Bank estimates around 9 million, more than half the population) and one of the most youthful populations in Southeast Asia.

-

The apparel/footwear industry is one of Cambodia’s largest employers (comprising 7% of the total workforce) and has played a significant role in the country’s economic development.

-

Cambodia has a diverse workforce, with over a third of workers employed in agriculture, manufacturing, and services sectors growing rapidly.

-

Most Cambodian workers are low-skilled and work in labor-intensive industries, however, the country has established policies to improve primary school enrollment (82% in 1997 to over 97%) and improve the quality of education and literacy rates, which remain lower than the world average.

-

While the official unemployment rate in 2022 was very low at 0.4%, the International Labour Organization (ILO) estimates that 93% of Cambodians work in the informal sector, likely underestimating the true rate.

-

Of note, the Cambodian government has been globally criticized for violation of human rights across its labor force.

Business Structures

-

Limited Liability Company (LLC): LLCs are the most popular type of business structure in Cambodia for foreign investors. An LLC can be 100% foreign owned or a comibination of Cambodian and foreign ownership. The LLC must consist of 1-30 shareholders and a minimum capital of KHR 4 million (USD$1,000).

-

Private Limited Company in Cambodia must have between 2 and 30 shareholders and at least one director. The director can be a Cambodian national or a foreigner. Private limited companies cannot issue shares or securities to the public and may have restrictions on the transfer of their shares. The minimum share capital required is KHR 4 million (USD$1,000).

-

Branch Office: A branch office is a foreign company’s extension in Cambodia. It is not a separate legal entity, but it is subject to Cambodian law. Branch offices are permitted to undertake commercial activities (buying and selling products) and can engage in manufacturing, processing, and construction.

-

Representative Office: A representative office is a foreign company’s presence in Cambodia to promote its products and services, but is not allowed to engage in any commercial activities.

Business Landscape

-

Cambodian state-owned enterprises (SOEs) are businesses that are owned or controlled by the Cambodian government. SOEs play a significant role in the Cambodian economy, accounting for about 10% of GDP, operating across a variety of sectors (energy, telecommunications, transportation, and finance).

-

Some of the largest SOEs in Cambodia include: Electricite du Cambodge (EDC): the national electricity company; Cambodia Telecom (CT): the national telecommunications company; Port of Sihanoukville: the country’s largest port; and Phnom Penh Water Supply Authority (PPWSA): the capital city’s water utility.

-

SOEs have been criticized for inefficiency and corruption. However, the Cambodian government has been working to reform the SOE sector and improve their performance.

-

The number of Cambodian small-medium enterprises (SMEs) have been increasing with a total number of 43,974, or 98% of all businesses and around 58% of GDP.

-

Cambodia’s informal sector makes up approximately 93% of its workforce, with countless businesses and workers that are not registered and do not pay taxes (e.g., street vendors, market stalls, and small family businesses). Informal workers also include construction workers, garment workers, and agricultural workers.

Notable Institutions

-

Ministry of Commerce (MOC): The MOC is the government agency responsible for regulating business and investment, including issuing business licenses, registering companies, and protecting intellectual property.

-

General Department of Taxation (GDT): The GDT is the government agency that manages tax collection. It also information and assistance to taxpayers, and resolves any tax disputes.

-

Council for the Department of Cambodia (CDC): The CDC is a government agency that promotes investment and economic development, and provides information and assistance to foreign investors, and helps them navigate the business environment.

-

American Chamber of Commerce in Cambodia (AmCham): AmCham Cambodia is a private sector organization that represents the interests of American businesses in Cambodia, and offes advocacy, networking, and business intelligence services.

-

Cambodia Chamber of Commerce (CCC): The CCC is a private sector organization that represents the interest of businesses in Cambodia and provides a number of services to its members, including advocacy, networking, and training.